Our Core Values:

All Heart All The Time

Always Looking for a Road to Yes

Innovation Inside and Outside the Box

Our Brand Promise:

Closing Experience that exceeds your expectation.

Unforgettable signing experience

Innovation in every transaction

Loan Professionals

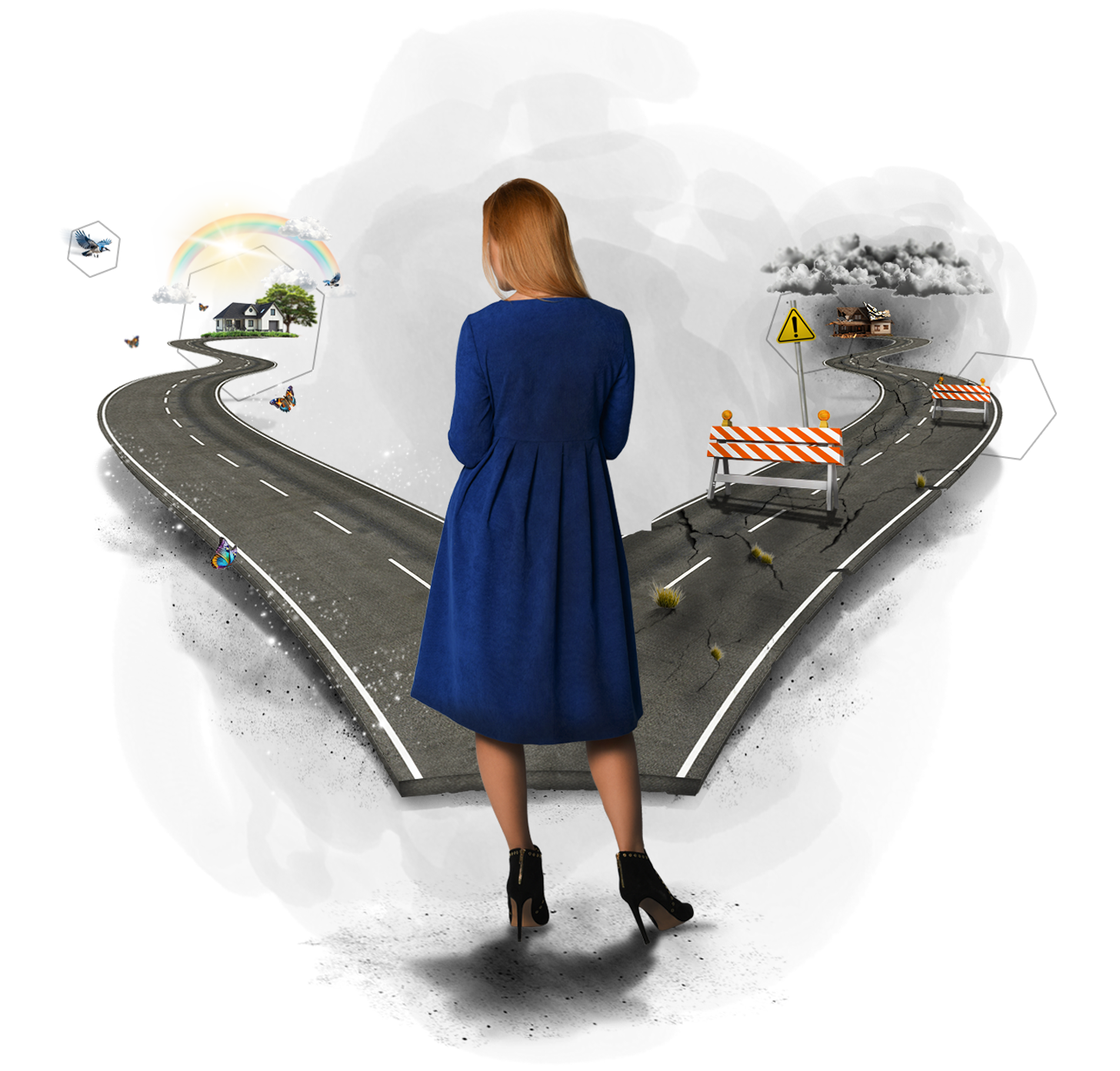

As a loan professional—whether you’re a lender, mortgage broker, loan officer, or loan processor—you play a pivotal role in helping buyers secure their dream homes.

Your expertise and diligence are critical in ensuring that the financing process goes smoothly. But what happens when you’re faced with challenges that slow down the process?

Challenges You Might Face

In your journey to get a buyer’s loan approved and the transaction closed, you may encounter several common issues when working with a title company:

1. Title Fee Delays: Getting accurate title fees quickly is essential for preparing a Good Faith Estimate. However, waiting for these fees can delay the entire loan process, leaving you and the buyer in a frustrating limbo.

2. Changes to Loan Amount or Lender: When the loan amount or lender changes during the buyer’s loan approval process, you need the title company to update the Title Commitment promptly. Unfortunately, this can sometimes take days, causing unnecessary delays and holding up the entire real estate transaction.

Meet Your Guide

Meet your guide, the escrow officer. From the moment the purchase contract is filled out and the listing and selling agents select an escrow officer, that professional becomes your key point of contact.

The escrow officer is your guide in getting all the documents and funding conditions satisfied, ensuring that the loan is funded and the transaction can close on time.

Plan in Place

To streamline your work, the escrow officer will reach out to introduce themselves, provide their contact details, and equip you with the tools you need to work more efficiently.

This proactive communication sets the stage for a smoother, faster process.

Get Started

To help you avoid the common pitfalls and keep the loan process on track, the escrow officer will guide you through the following steps:

1. Access Axiom: You’ll be shown how to log in to Axiom, the platform that brings together all the tools you need to close the transaction on time. Axiom is designed to make your job easier, providing everything at your fingertips.

2. Pull Your Own Fees: In Axiom, you can instantly pull the title fees you need, giving you the ability to prepare your Good Faith Estimate without waiting on someone else. This saves you time and helps you move the loan process forward more quickly.

3. Update Loan Information Instantly: If the loan amount or lender changes, you can update the loan amount and proposed insured on the Schedule A of the Title Commitment instantly in Axiom. This capability is invaluable, saving you days of waiting and keeping the transaction on schedule.

Avoiding the Pitfalls

Working with outdated systems or title companies that lack efficient processes can lead to delays that risk losing an interest rate lock, frustrate everyone involved, or even jeopardize the entire transaction.

By using a title company equipped with the latest technology and a commitment to excellence, you avoid these failures and ensure a smoother, more successful closing process.

Celebrate Your Success

With the support of cutting-edge title technology, you’ll experience a smoother closing process, gain more time by instantly satisfying document conditions, and have the energy to celebrate each successful transaction.

Partner with us, and together, we’ll ensure every loan you process ends in success.